COVID-19's Impact on the Industrial Manufacturing Sector in Europe: Breeding Ground for Corporate Divestments?

Accelerated by the effects of the COVID-19 pandemic, many companies have started to evaluate their business models considering structural changes presumed in a post-COVID environment. Markets all over the world have suffered through the economic crisis caused by the pandemic and have become even more challenging and volatile.

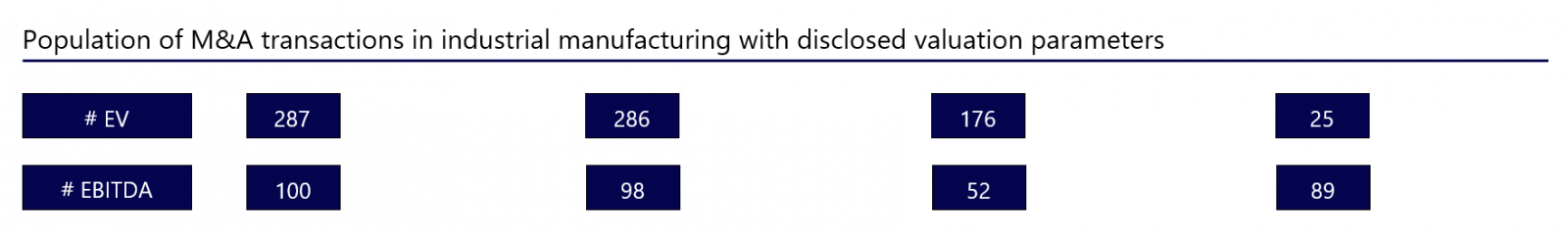

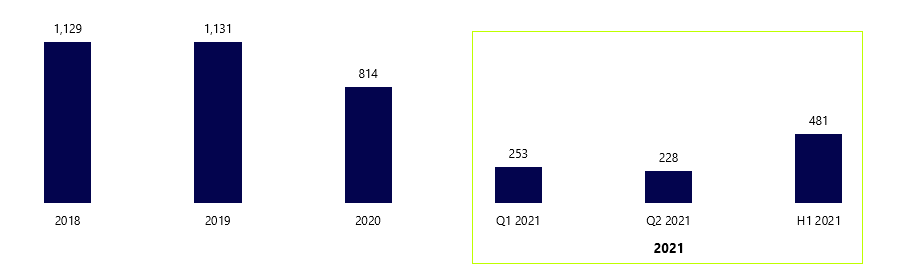

Considering the overall transaction environment in past years, a reduction in the total number of M&A transactions and likewise in the deal volumes have been observed in Europe. The number M&A transaction in the Industrial Manufacturing sector in Europe decreased significantly between 2018 and 2020. While 1,129 deals accounted for a total transaction volume of EUR 66 bn in 2018, only 814 deals with an aggregate deal volume of EUR 60 bn were recorded in 2020. Partitioning M&A activity by deal types, the largest share of corporate carve-outs and spin-offs over total transactions was observed in the field of industrial manufacturing, one of the main economic sectors in Europe. In this context, larger corporations are constantly seeking to adapt to new market conditions and are increasingly taking a critical look at divesting companies or business units from their portfolios.

Number of Deals per Year

According to M&A database Mergermarket, the number of M&A deals in the industrial manufacturing space decreased from 1,129 (2018) and 1,131 (2019) to 814 in 2020. Year-to-date deal numbers in 2021 are also lower when compared to 2018.

Disclosed average deal values and EBITDA multiples

.png)

The graph illustrates the development of average deal values and average EBITDA multiple from 2018 to H1 2021. The average deal value decreased to EUR 152 mn in 2019 and more than doubled to EUR 343 mn in 2020, mainly driven by the EUR 17.2 bn sale of TK Elevator to an investor consortium. The averageEBITIDA multiplefell by 2.3x to 13.7x in 2019 and reached pre-COVID levels of 16.1x in 2020. The first half of 2021 indicates that the EBITDA multiples are likely to be slightly below 2018 and 2020 levels, with an average H1 2021 EBITDA multiple of 15.2x. The largest corporate divestments are shown in the following chart.

The by far largest corporate divestment was the EUR 17.2 bn sale of German TK Elevator to an investor consortium in 2020. The investment proceeds from the transaction were used to strengthen Thyssenkrupp’sbalance sheet and advance the development of the remaining businesses. Bombardier’s divestment of the German transportation business unit in 2018 was the second largest divestment since 2018 with an enterprise value of only EUR 7.1 bn, less than half the value of TK Elevator. Other divestments include the sale of the industrial segment of Ingersoll Rand, headquartered in Belgium, Viridor, the UK-based recycling, renewable energy and waste management company, and metso minerals, headquartered in Finland.

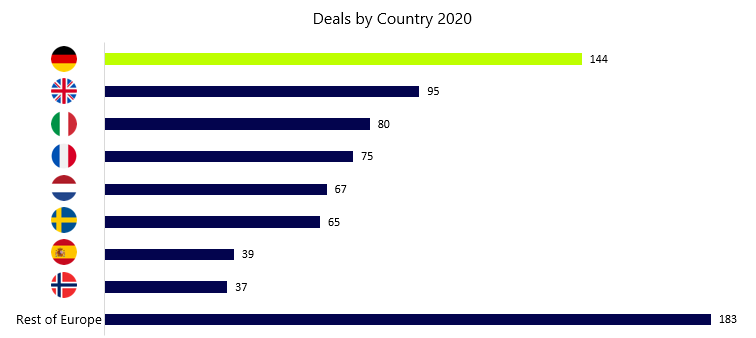

In 2020, Germany was the country experiencing highest M&A activity, as about 18% of all targets were German companies, followed by the United Kingdom (12%), Italy (10%) and France (10%). By focusing on corporate divestments deals from all the European deals considered, it becomes apparent that the majority of corporate divestments in the European industrial manufacturing sector are in the small and mid-cap segment. While some corporations use corporate divestments primarily to reduce losses, others use the proceeds generated from the sale to strengthen and grow their core business. The industrial manufacturing sector appears to be very active in terms of corporate divestments compared with other European economic sectors. There is an discernible tendency that companies in the industrial manufacturing sector primarily divest loss-generating activities.

The following sections highlights four key market drivers in 2020/2021 with regard to corporate divestments in the European industrial manufacturing sector.

- The pandemic has had a significant impact on the industrial manufacturing sector. Resilient segments of the industrial manufacturing sector were able to adjust to the pandemic and were less involved in corporate divestments, while less resilient segments experienced more difficult times during the pandemic and, therefore, engaged in divesting troubled, loss-generating business units.

- Advancing digitalization allows for cost savings by automizing, digitalizing and simplifying the production process. However, the digitalization of production processes requires considerable investments. Companies that had invested in digital infrastructure pre-COVID benefit from their competitive, digital advantage, as crisis-ridden companies will likely not be able to finance the adaption of digital technologies.

- International supply chains are particularly exposed to the worldwide pandemic as well as to economic sanctions and trade barriers. As globalization continues, more and more companies are operating across borders on a global scope with subsidiaries that have their own, integrated supply chains. As a result, subsidiaries have become less dependent on their parent companies for vital business operations and, therefore, individual sales of foreign business units in non-core geographical markets will drive European corporate divestments.

- Raw material prices (e.g. for wood,steel and plastics) have increased significantly. Uncertainty and volatility of price developments induce problematic challenges for companies in the asset-heavy industrial manufacturing sector. Unfavorable price trends have direct impact on the profitability of the business operations. Especially small to mid-sized companies, for which hedging of raw material prices is too costly, will consider refocusing on their core business. This, in turn, will boost the number of corporate divestments in segments with exorbitantly high raw material price increases.

Due to its diverse subsectors, the industrial manufacturing sector has an immense impact on the entire European economy. Industrial groups weakened by the COVID-19 pandemic are under pressure to divest unprofitable business units and operations. Among other things, they will have to reduce debt and generate free cash flows via M&A activities. Following the subdued M&A market in 2020 – especially with its low number of corporate divestments – a substantial increase in carve-outs and spin-offs is estimated to be observed in the second half of 2021 and going forward. Advancing digitalization, the increasing independence of subsidiaries due to integrated supply chains and the climbing raw material prices are expected to be among the key drivers for corporate divestments.

Christian Saxenhammer, CDI Global Germany & CDI Industrial Industry Co-Leader