Overseas Acquisitions: A Unique Opportunity for Chinese Chemical Companies to Gain Competitive Advantage

Dr. Kai Pflug, Management Consulting – Chemicals (kai.pflug@mc-chemicals.com);

Daniel Philip Senger, CDI Global (daniel.philip.senger@cdiglobal.com)

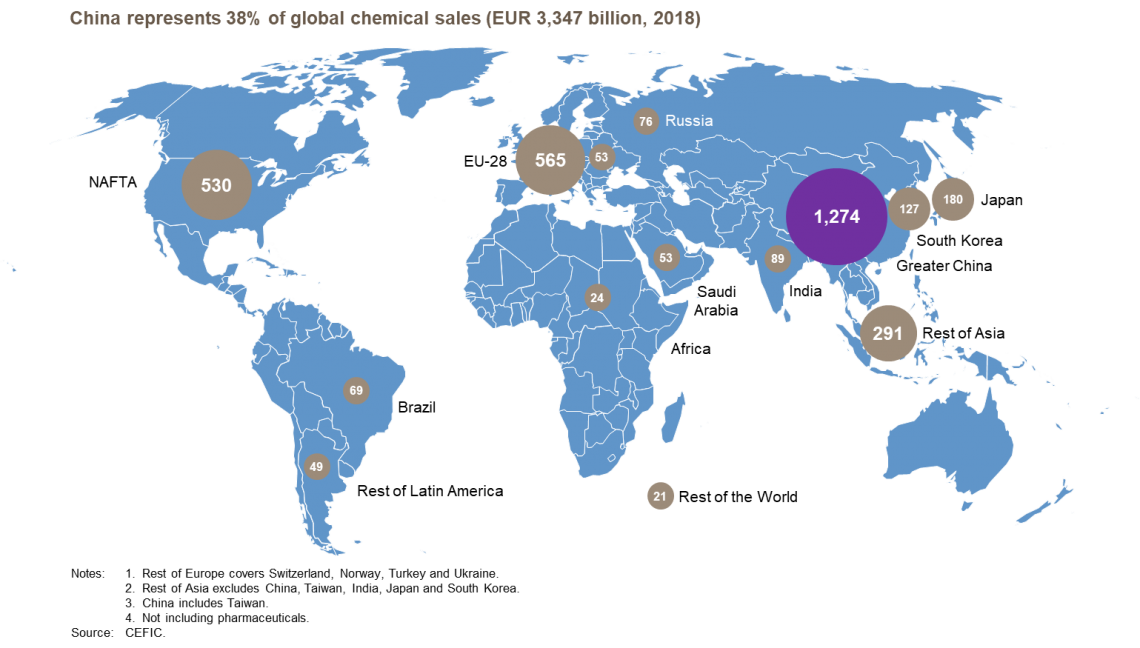

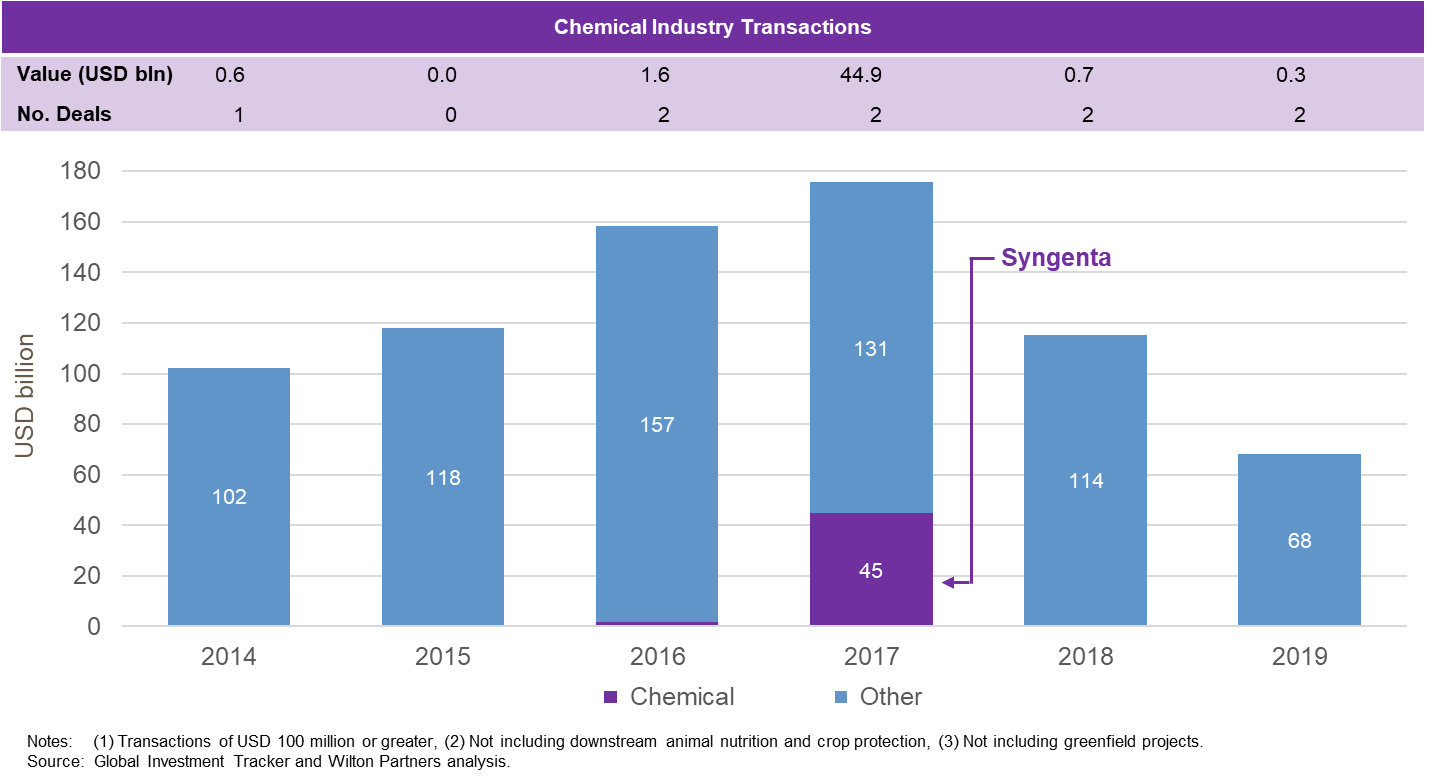

China is by far the largest market for chemicals, accounting for about 38% of global chemical sales (Fig. 1). In addition, its growth continues to be above the global average for the chemical industry. As a consequence, Chinese chemical companies have so far largely focused on their presence in the domestic Chinese market. Relatively limited effort has been spent to expand overseas, whether by organic growth or by acquiring overseas chemical companies (Fig. 2).

Fig. 1: China`s share of the global chemical market

Fig. 2: China Outbound chemical M&A transactions

Fig. 2: China Outbound chemical M&A transactions

However, this is likely to change. A major reason is the gradual decline of chemical growth within China, driven both by lower GDP growth and by a shift of GDP growth away from manufacturing and towards services. This has already led to substantial overcapacity in certain chemical segments, particularly commodities. In addition, some labor-intensive industries that are important customers of the Chinese chemical industry are gradually moving out of China as increasing labor costs reduce the competitiveness of, e.g., textile production. If the past gives any indication, that means that related chemical segments such as textile chemicals, dyes etc. will also move out of China.

Another reason is that China`s chemical industry gradually shifts towards specialty chemicals, which generally are more profitable and have higher growth prospects than commodities. However, the production volume of specialty chemicals is much smaller, and they are more knowledge-intensive. As a consequence, to make full use of economies of scale, a specialty chemicals producer ideally needs to supply customers globally.

Finally, very recent developments such as increased trade barriers and the coronavirus have shown the limits of producing only in one location. The risk of major disruptions is simply too high.

Given these changes, overseas expansion is an option that any strong and sizeable Chinese chemical company should consider. If done right, such an expansion can both bring additional foreign profits and at the same time improve the company`s position in the domestic market. Currently, an acquisition of a foreign chemical company overseas is a particularly relevant option as stock market valuations have crashed in the last few weeks. In addition, an acquisition is a faster approach to entering a foreign market than an organic investment, and it offers additional advantages due to the material and immaterial resources of the acquired company.

Chinese chemical companies should not acquire foreign players on a whim. However, there are several very convincing reasons to buy a chemical company overseas, which will be discussed below. While not all will be valid for every potential buyer, frequently several may be applicable in an individual case.

Acquisition of Technology or Advanced Products:

In many areas particularly in specialty chemicals, foreign players own technologies and products that are superior to those owned by Chinese companies. Acquiring such a company thus brings obvious benefits that can also be utilized in the domestic market. For example, ChemChina primarily bought Syngenta for its portfolio of patented active ingredients, and Shaoxing Eastlake acquired German company Ehrfeld in order to get access to their leading microreactors.

Access to a Growth Market:

Successful entry into an overseas market depends on a suitable distribution channel, which may be obtained by acquisition of an existing player. For example, Kingfa established a strong presence in India via the acquisition of Hydro and thus is now in a position to benefit from the long-term increase in automotive demand in India.

Establishing a Global Presence to Serve Customers Globally:

In order to serve global customers in a timely manner, it may be required to have production capacity close to their locations. For example, Wanhua acquired Hungarian isocyanate producer Borsod in order to supply material to European customers.

Avoidance of Trade Barriers:

Establishing production in multiple countries may help avoid trade barriers. For example, when in 1981 Japan had to restrict its car imports to the US, the country established production in the US to avoid these barriers. It is conceivable that Chinese producers of, e.g., agrochemicals or pharmaceutical active ingredients take a similar step and set up production of these materials in the US, ideally by taking over an existing production facility.

Reducing the Risk of Production in a Single Country:

While somewhat related to the previous point, this is a somewhat different aspect. Customers of chemicals may be reluctant to strongly rely on a chemicals producer with production facilities in only one country, as such a setup is prone to disruptions (as the current coronavirus shows). A company that can produce the same chemical in multiple countries will be regarded as a more attractive supplier.

Downstream Integration:

China`s chemical industry currently does not capture the full value of many of its products in areas such as agrochemicals and pharma chemicals, as a large share of its exports are in technicals, APIs and pharma intermediates. Acquiring, e.g., a local agrochemical company in Brazil or a producer of pharma generics in India would increase the share of value captured.

Upstream Integration:

In some cases, acquisition of a company abroad can be a means of securing necessary raw materials, for example for lithium ore (for battery producers) or for crude oil (for petrochemical companies)

Improving the Quality Perception:

In some sensitive chemical areas such as food ingredients, flavors, cosmetics etc., China still has problems with the perception of low quality (even within China). Acquisition of a foreign company (e.g., a European producer of food ingredients or a Korean producer of cosmetics ingredients) would allow an improvement of the perceived quality.

Following customers:

As mentioned above, it is likely that some chemical segments will gradually move out of China as their key customer industries (e.g., textile, leather) relocate to countries such as Vietnam, Bangladesh or India. Acquiring a local company in these segments may be a way of protecting overall global sales from declining despite a reduction in China.

Changes in Business Model:

Many leading Western chemical companies try to shift their business model towards greater service orientation. This shift, in which the customer pays for a defined service or performance rather than for a defined amount of material (e.g., for the surface area coated rather than for the amount of paint delivered), will require a closer local presence but will also allow for greater value creation.

Potential Government Support:

Last not least, initiatives of the Chinese government such as the Belt-and-Road Initiative seem to indicate the official support for overseas expansion of Chinese companies. Such overseas expansion thus should also improve the domestic standing of a company.

As these points illustrate, there are multiple reasons for Chinese chemical companies to pursue overseas acquisitions. To summarize, positive results from such acquisitions include

- Increases in profitability (as profitability tends to be relatively low in China)

- Better use of economies of scale (as costs can be diluted for a larger market)

- Getting new technologies (as acquisitions bring new products, ideas and technologies)

- More resilient business (as business risk is spread across multiple countries)

- Greater value capture (as the Chinese company increases its share of activities)

However, it also needs to be stated clearly that there are obstacles to successful acquisitions, in particular for Chinese companies with limited M&A experience in the Western world. It is therefore highly advisable to secure the support of an advisor with experience in areas including the Chinese and Western Chemical Industry as well as in Cross-Border M&A transactions. Such an advisor will – among other tasks – ensure that

- Enough reliable local information on the target company, the markets, laws etc. is acquired

- The acquisition fits with the strategy and objectives of the buyer

- Synergies will be accounted for and can thus be incorporated in deciding the offering price

- Cultural differences between, e.g., Chinese and Western culture are taken into account

- An integration plan will be prepared that maximizes the gains from the acquired company

Currently, the valuations of many Western chemical companies are relatively low as a result of the coronavirus. In addition, some Western companies will struggle with liquidity issues, lack of export demand, and other issues. This may offer decisive buyers a chance to secure a good deal, if action is taken quickly.