Technology and Innovation: Driving the New M&A Wave in Functional Ingredients

The functional ingredients market has not only had excellent behavior during Covid-19 but also continues to attract great attention from industrial and financial buyers.

Before diving into the key factors driving this M&A spree, let's briefly define what we understand as a functional ingredient. Basically, we are talking about compounds, mainly originating from natural sources, intended to produce a positive effect on our health. The term "functional" is meant to convey the function to produce a positive health outcome via physiological activity in the body. Examples of functional ingredients are vitamins, probiotics, proteins, or compounds such as DHA (Omega-3).

Among the fundamental reasons making this sector highly attractive for investors, we would emphasize the following five:

Sizeable and growing market, estimated at €90bn and expected to reach €140bn by 2025 (Euromonitor).

- Sizeable and growing market, estimated at €90bn and expected to reach €140bn by 2025 (Euromonitor).

- Soaring health awareness on a global scale.

- Highly fragmented sector.

- Focused on natural and environmentally friendly products.

- The increasing relevance of technology and innovation.

Out of this list, item five, centering on the importance of technology, is gaining weight in determining the valuation of functional ingredients companies. Similarly, to biotech firms, ingredients manufacturers are also luring big pharma. As the latter face patent cliffs, harder regulation, and declining returns on R&D, nutraceuticals products are used to diversify their portfolios and shorten go-to-market intervals. Pharma companies favor nutraceutical companies with strong R&D backing.

But, how do functional ingredients producers approach R&D? Many firms drill into the extensive libraries of basic and clinical research to extract papers supporting health claims of generic ingredients. This is a good start, but not sufficient. Without specific clinical trials, using the particular ingredient, the product will not be able to make a specific claim. Novelty and being able to make specific claims are key to making an ingredient more valuable.

Take the example of olive oil, which compounds have vastly been studied for centuries. At the beginning of 2020, Harvard published the outcome of a comprehensive research study “Olive Oil Consumption and Cardiovascular Risk in U.S. Adults”, published in the Journal of the American College of Cardiology, which followed the fat intake of more than 90.000 individuals over a period of 24 years. The study concluded that the consumption of more than 7 grams of olive oil a day corresponded to a 14% lower risk of suffering from cardiovascular diseases in general, and an 18% lower risk of suffering from coronary heart disease. Building on this result, a company extracting natural polyphenols from olive oil, may, for example, invest in running a clinical trial to test the positive effects of its polyphenols as active antioxidants and, furthermore, investigate whether the intake of its compound contributes to the protection of blood lipids from oxidative stress (in fact, this claim has actually been approved by EFSA, the European FDA). If the dosage of the active ingredient is not higher than what would have been consumed in a couple of tablespoons of olive oil, proving the safety of the compound should be relatively straightforward. If finally, the results can be put into a claim on the label of the product, the ingredient should be able to command a hefty margin.

Different from synthetic drugs developed by big pharma, the investment needed for clinical trials of natural ingredients stemming often from plants commonly consumed in our daily lives, tends to be a fraction of that required by the former. The time to run the trials is also significantly shorter. The combination of both factors (lower R&D budget plus faster approval times), makes functional ingredients especially attractive to pharma companies.

Building on the significance of innovation and the search for differentiation, we also find that important investments are being made in aspects such as the extraction/manufacturing process or the delivery formats. The pursuit of the ‘Natural’ starts with the traceability from source to market, where ecological plantations free of pesticides are rapidly gaining ground and, continues, with the quest to manufacture the final products with no or minimal addition of chemicals (a mechanical process free of chemicals is preferred to one where chemicals are needed for the synthesis of the ingredient). Numerous ingredients players are turning to IP protection in order to enhance, via patents covering the manufacturing process, the value of their proprietary ingredients.

Delivery formats and packaging are further means to add value to a functional ingredient. Attractive delivery presentations, such as functional gummies (gummies containing functional ingredients), with a great look and organoleptic quality, are rapidly gaining shelve space.

Transactional activity in the functional ingredients space

In late 2019, Dupont Nutrition & Biosciences and International Flavors & Fragrances (IFF) created a €45bn nutrition and flavor giant, combining complementary portfolios, including nutrition and probiotics. At the time, Andreas Fibig, IFF’s CEO announced that "As consumer demands are shifting towards natural health and wellness products, the combination of IFF and DuPont's nutrition business will be among the only industry players able to lead and accelerate these trends" with leading market positions in taste, texture, nutrition, enzymes, cultures, soy proteins and probiotics. A year earlier, IFF had acquired Frutarom, an Israeli-based company that specializes in the production and distribution of extracts for flavor and fragrance. Also, in 2019, agri-food giant Avril acquired German lecithin producer Lecico. Swiss flavors and extracts titan, Givaudan, has also been extremely acquisitive, with its landmark acquisition of Naturex in a deal valued at over €1,5bn, with a clear strategy to substitute artificial colors and flavors in favor of natural and organic compounds. More recently (April 2021), Unilever has agreed to acquire Onnit, a leading wellness supplements and lifestyle products provider, adding to its wellness and supplements portfolio. Firmenich, with the acquisition of Natural Flavors, Kerry (just announced the acquisition of Biosearch), ADM, Ingredion, or the Germans Symrise and Evonik have also been active buyers in the space.

Another cohort that has caught the attention of functional ingredients players are the likes of food companies such as Nestlé (acquired PersonaTM, Aimmune, or Nuun), Danone (just acquired nutritional supplements manufacturer Complan Food UK) or the already mentioned Unilever, seeking to improve margins in the mature food industry.

Finally, we are also seeing strong interest in natural ingredients companies from private equity firms, and this activity has recently accelerated as buyers are being able to travel and perform onsite due diligence. Solina, a French company specializing in taste and visual solutions, backed by Ardian, has completed close to ten acquisitions in the last ten years. Large investment firms such as Carlyle or Eurazeo have also enthusiastically participated in this space. In fact, a few ingredients companies are offering such remarkable growth trajectories that they get passed from one PE to another. Iberchem, a Spanish flavors, and fragrances company, changed PE hands four times (Espiga, Capital Alianza, Magnum, and Eurazeo) before being recently sold to the British specialty chemicals company Croda.

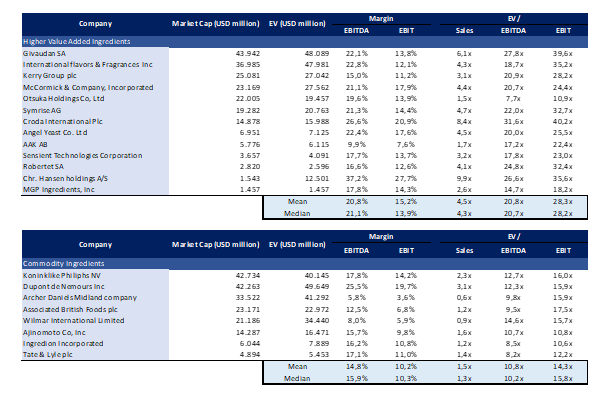

When examining valuations, we find a robust sector reaching peak multiples. Flavor houses such as IFF, Givaudan, Sensient or Symrise, trade at a significant premium compared to their more commodity-like peers. The former, tend to be characterized by having strong IP and dispensing of large R&D budgets. The latter, are viewed more as suppliers and traders, lacking significant IP, and therefore trading at lower multiples. The table below shows the valuation gap between both groups.

Market Multiple Ingredients Companies

At CDI Global, we are highly optimistic about the sector and are actively helping, not only large corporations in the identification of targets but also smaller functional ingredients players in the strategic execution of their growth plans. While large corporations are leveraging our worldwide network to find simultaneously potential targets in a selection of countries, smaller actors benefit from our global reach to access local and international venture and private equity houses to fund their business plans.

Carmelo de las Morenas, CDI Global Iberia